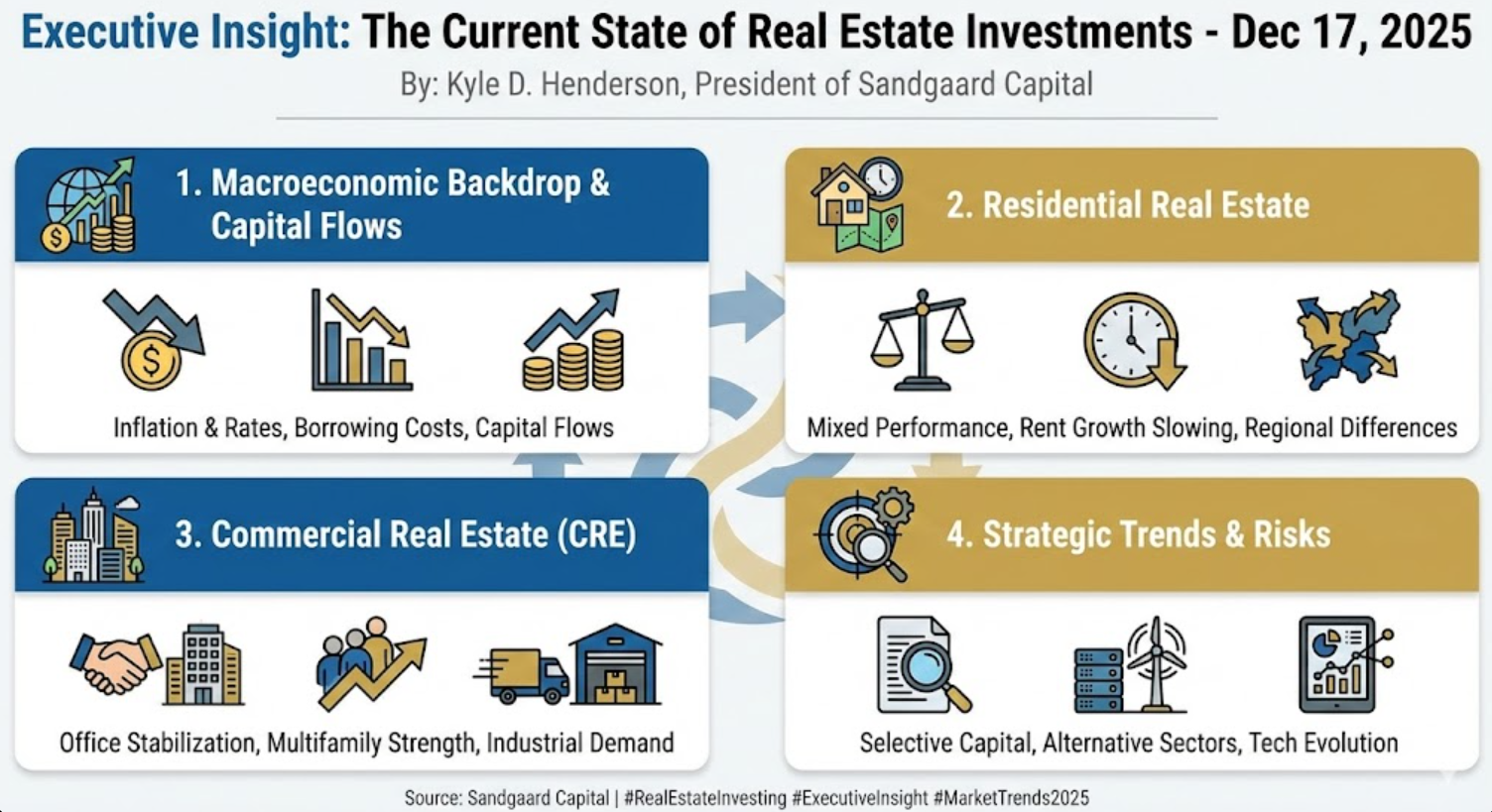

Executive Insight: The Current State of Real Estate Investments

By: Kyle D. Henderson, President of Sandgaard Capital

As we close out 2025, real estate investing remains a complex and dynamic component of diversified portfolios. Across residential and commercial sectors, divergent trends driven by macroeconomic conditions, capital markets evolution, shifting occupier and consumer behavior, and technological change are shaping near-term performance and strategic opportunity sets.

1. Macroeconomic Backdrop and Capital Flows

Persistent inflation pressures and elevated interest rates have defined much of 2025, though late-cycle easing has begun to emerge in financial markets. These conditions have materially influenced borrowing costs, investment pacing, and capital allocation decisions.

Borrowing cost sensitivity continues to suppress transaction volume in rate-sensitive sectors, with capital deployed selectively toward assets demonstrating durable cash flow, defensive characteristics, and strong sponsorship. Institutional capital remains cautious, with allocations to real estate still below pre-pandemic norms in many portfolios, even as valuation stability improves. At the same time, global private wealth growth continues to expand the pool of investors seeking income-producing real assets as a complement to public equities.

2. Residential Real Estate

The residential real estate market continues to exhibit mixed but broadly resilient performance.

Total U.S. residential property values reached historic highs in mid-2025, reflecting cumulative appreciation over the prior cycle. However, rent growth has slowed materially, indicating moderation in rental inflation even as absolute rent levels remain elevated compared to earlier years. Home price performance remains highly regional, with certain markets still experiencing appreciation while others show stabilization or modest declines driven by affordability constraints and local economic conditions.

For investors, residential strategies remain compelling where supply is structurally constrained, migration trends are favorable, or operational scale supports consistent cash-flow generation. Build-to-rent platforms and long-term rental portfolios continue to attract institutional interest.

3. Commercial Real Estate (CRE)

Commercial real estate is undergoing a measured transition marked by sector-specific divergence.

Office

Office markets are showing early signs of stabilization, particularly in high-quality, well-located Class A assets. Occupancy improvements remain uneven, and refinancing pressure continues for assets facing near-term debt maturities, especially in secondary markets or older product.

Multifamily

Multifamily remains one of the strongest CRE sectors. Demand from renters persists, effective supply remains relatively tight in many markets, and investor interest continues to outpace other property types. Pricing and transaction activity in multifamily have consistently led broader CRE performance.

Industrial and Logistics

Industrial real estate continues to benefit from structural e-commerce demand and supply-chain reconfiguration. While rent growth has moderated as new supply delivers, long-term fundamentals remain supportive.

Retail and Hospitality

Retail has demonstrated notable resilience, supported by consumer spending and disciplined new development. Hospitality performance has rebounded strongly, with occupancy and revenue metrics exceeding pre-pandemic levels in many leisure-oriented markets, though urban and convention-driven assets remain more variable.

Overall, transaction pricing across CRE improved during 2025, with multifamily and industrial leading gains and other sectors showing incremental recovery.

4. Strategic Trends and Emerging Themes

Selective Capital Deployment

Investors are prioritizing asset quality, tenant durability, and sustainable income over speculative appreciation. Underwriting discipline and conservative leverage structures remain central to capital allocation decisions.

Alternative Real Estate and Specialized Sectors

Non-traditional real estate segments are increasingly incorporated into diversified portfolios. Build-to-rent communities, senior housing, life sciences facilities, and data center infrastructure are being evaluated as growth complements to traditional CRE exposure.

Technology and Asset Management Evolution

Advances in data analytics, valuation modeling, and tenant experience platforms are influencing acquisition strategy and asset management practices. Adoption remains uneven, but technology-enabled insights are increasingly viewed as a competitive advantage.

5. Risk Considerations

Real estate investing at this stage of the cycle presents several material risks. Refinancing headwinds remain significant for assets with near-term debt maturities, particularly where valuations have reset or income growth is constrained. Interest rate uncertainty continues to influence leverage costs and exit timing. Geographic and sector-specific dynamics require granular analysis, as aggregate market indicators can obscure localized challenges or opportunities.

Conclusion

The real estate investment landscape in late 2025 reflects a cautious normalization following years of volatility. While macroeconomic uncertainty and structural shifts persist, high-quality real assets with durable cash flows and strong fundamentals continue to offer attractive risk-adjusted opportunities. Disciplined capital deployment, sector selectivity, and active asset management remain essential for investors navigating this evolving environment.

Liquidity Crunch or Golden Opportunity?

By: Kyle D. Henderson, President of Sandgaard Capital

Why Market Dislocations Create Once-in-a-Decade Buying Windows

Periods of financial stress often dominate headlines with stories of “crisis” and “uncertainty.” Investors pull back, valuations fall, and liquidity dries up. But history tells us that what feels like a liquidity crunch is often, in reality, a golden opportunity.

At Sandgaard Capital, we view market dislocations not as reasons for retreat, but as rare openings to build enduring value.

The Nature of Market Dislocations

Market dislocations occur when asset prices diverge sharply from their intrinsic value. These gaps are usually caused by external shocks—rising interest rates, geopolitical instability, or systemic risk events—that trigger broad selling regardless of underlying fundamentals.

Forced sellers create bargains. Institutions under pressure to raise cash often sell quality assets at discounts.

Sentiment overtakes fundamentals. Panic drives decisions more than cash flows or balance sheets.

Liquidity premiums emerge. Investors with capital on hand can command superior terms in deals.

Why Crises Create Opportunity

Across cycles, some of the best-performing investments are made at moments of maximum pessimism.

2008–2009: Those who stepped into real estate, private equity, or even public equities during the Great Financial Crisis saw generational returns.

2020 Pandemic Shock: Investors who bought when markets seized up in March 2020 were rewarded within months as markets rebounded.

Today’s High-Rate Environment: Many sectors—real estate, private credit, and growth equity—are experiencing valuation resets that may only come once a decade.

The lesson is clear: the biggest gains are often captured by those willing to act when others stand still.

The Sandgaard Capital Lens

We approach dislocations with three guiding principles:

Liquidity is a Strategy. Maintaining cash reserves or access to flexible capital allows us to move decisively when opportunities arise.

Focus on Quality. Not every “cheap” asset is a good buy. We prioritize strong cash flows, proven management, and sectors with long-term tailwinds.

Long-Term Horizon. We invest through cycles, not around them. The goal is to acquire enduring assets at attractive entry points, not to time short-term market swings.

Where We See Opportunity

Private Credit: As banks retreat, direct lenders are stepping in, often at yields and structures not seen in years.

Real Assets: Certain real estate classes, particularly niche or undervalued segments, are resetting to prices that make long-term sense again.

Select Public Equities: Market pessimism has compressed valuations in sectors like healthcare technology and industrial innovation, where we see growth potential.

Conclusion

Liquidity crunches are uncomfortable by design—but they are also moments of truth for disciplined investors. For those with patience, courage, and access to capital, these periods can transform portfolios for decades to come.

At Sandgaard Capital, we believe today’s market environment offers precisely that: a once-in-a-decade window to turn short-term dislocation into long-term advantage.

The State of AI in 2025

By Joachim Sandgaard, Executive Director, Sandgaard Capital

AI Beyond the Hype

2025 marks a turning point: AI has shifted from experimentation to essential infrastructure. What began as tools for niche teams are now embedded across industries, reshaping workflows, strategy, and competition.

Adoption at Scale

Enterprise: Over 70% of companies report regular use of generative AI. The focus has moved from pilots to redesigning business processes.

Consumers: More than 60% of U.S. adults use AI, but only a fraction pay for premium services — signaling untapped monetization potential.

Agents, Not Tools: AI is evolving from assistants to autonomous “agents,” capable of planning and executing tasks with minimal oversight.

Value & Differentiation

The real gains come when firms re-engineer workflows around AI, instead of layering it on. Leaders are building governance, training, and change management into their rollouts — while laggards struggle with ad-hoc adoption.

Risks & Governance

AI’s growth brings challenges: accuracy, IP, privacy, and environmental impact. The International AI Safety Report highlights risks from cyber misuse to deepfakes. Governments are racing to regulate — with the U.S. favoring innovation-first, the EU taking a risk-based stance, and others pursuing state-led strategies.

Infrastructure Race

Compute remains the bottleneck. Mega-projects like OpenAI, Oracle, and SoftBank’s $500B Stargate data center initiative show the scale of investment required. At the same time, edge AI and sovereign national models are gaining traction to reduce dependency on a few global players.

Outlook

AI is no longer about proving potential — it’s about scaling responsibly. The winners will be those who:

Build trustworthy, auditable systems

Invest in compute and edge infrastructure

Deploy specialized, modular AI rather than one-size-fits-all models

Treat safety and governance as competitive advantages

Closing

2025 is the year AI becomes unavoidable. The question is not if it changes industries, but how responsibly organizations harness it. Those who align innovation with trust and resilience will lead the next decade.

Private Equity in England and Denmark: A 2025 Outlook

By Martin Sandgaard, Head of European Operations, Sandgaard Capital

Private equity across Europe is entering a new chapter. After a turbulent few years, deal activity is slowly picking up, yet conditions vary widely between markets. England offers scale, depth, and liquidity, while Denmark provides stability, strong institutional support, and niche opportunities. For Sandgaard Capital, understanding these differences is central to our European strategy.

England / UK: Scale With Complexity

The UK private equity market remains one of the most active in Europe. Mid-market deal activity is recovering as valuation gaps narrow, with buy-and-build strategies and operational transformations leading the way. Yet competition is fierce, exits through IPOs remain challenging, and regulation around carried interest and alternative assets continues to evolve.

Sectors drawing the most attention include tech-enabled services, healthcare, energy transition, and consumer brands with digital reach. For us, the UK requires selectivity: targeting defensible, mid-market businesses where Sandgaard Capital’s operational expertise can create real value. Regional opportunities outside London are also becoming more attractive as investors look beyond the capital.

Denmark: Stability and Niche Plays

Denmark’s private equity market is quieter, with fewer large-scale transactions, but it offers unique strengths. Institutional investors—particularly pensions—remain strong backers of private equity, creating a stable funding base. Local firms such as Axcel and Polaris are active, with particular momentum in software, healthcare, and renewable energy.

The regulatory environment is predictable, digital infrastructure is advanced, and competition for deals is more measured compared to the UK. While deal volume is lower, Denmark is well-suited for disciplined investors seeking targeted opportunities, co-investments, and platforms that can scale across the Nordics.

Strategic Balance

England and Denmark present very different private equity profiles. England offers high liquidity, but with intense competition that demands strong conviction and operational edge. Denmark, by contrast, is more modest in scale yet less crowded, allowing disciplined investors to find value without the same bidding pressure.

Institutional capital is strong in both markets, but Denmark stands out with its exceptionally deep pension and insurance base, providing reliable support for private equity strategies. Regulatory conditions also diverge: the UK environment is more fluid, with ongoing discussions around carried interest and alternative investment rules, while Denmark remains predictable and stable.

Finally, sector opportunities differ in breadth. England offers wide-ranging plays across technology, healthcare, energy transition, and consumer sectors, while Denmark’s opportunities are more niche—particularly in software, healthcare, and renewables—yet well aligned with long-term growth themes.

Private Equity in the U.S. in 2025: Navigating Uncertainty, Opportunity, and the New Normal

By Kyle D. Henderson, President, Sandgaard Capital

Private equity has always thrived on its ability to adapt to changing conditions, and that resilience is being tested again in 2025. Over the past several years, firms have faced a series of headwinds—rising interest rates, stubborn inflation, regulatory uncertainty, and a more difficult exit environment. Yet even in the midst of these challenges, opportunity is far from gone. At Sandgaard Capital, we see an industry in transition—one that rewards discipline, operational focus, and long-term perspective.

The Current State: Key Trends & Challenges

Capital deployment remains strong, but the playbook has changed. Firms still sit on significant amounts of dry powder, yet they are deploying with greater caution. Rather than chasing aggressive growth stories, investors are prioritizing resilient business models, recurring revenue streams, and conservative leverage. The era of easy money is behind us, and selectivity has become the new norm.

Exits, meanwhile, are proving harder to come by. IPOs remain limited, and strategic buyers are cautious. Many portfolio companies are being held longer than originally planned, delaying distributions to limited partners. To bridge the gap, continuation funds, sponsor-to-sponsor deals, and recapitalizations are becoming more common.

Valuations are also adjusting. Higher borrowing costs and tighter credit conditions are pressuring multiples, especially in leveraged buyouts. The firms that will win in this environment are those that can create true operational value—improving processes, reducing costs, and investing in technology—rather than relying solely on financial engineering.

Layered on top of these economic dynamics is a shifting regulatory landscape. The SEC, tax authorities, and policymakers continue to debate new rules that could reshape the industry. At the same time, investors are demanding more transparency, stronger governance, and credible ESG strategies. These pressures are changing not just how deals are structured, but how value is measured.

Finally, sector specialization and diversification are proving more important than ever. Firms with deep expertise in healthcare, technology, infrastructure, and renewables are seeing steady deal flow. Others are leaning into private credit, secondaries, and distressed opportunities—areas where flexibility and creativity can open new paths to returns.

What It Means for Sandgaard Capital

For us, the message is clear: discipline and adaptability are the keys to thriving in this environment. We’re focused on businesses with strong fundamentals, capable leadership, and cash flow that can withstand volatility. Our position as a family office allows us to be patient with exit timing, embracing creative solutions when traditional IPO or M&A paths are less attractive.

Operational value creation is at the center of our approach. We invest in the company behind the company—building better systems, talent, and ESG readiness. This work not only protects against market headwinds but positions our portfolio companies for durable, long-term success.

We’re also keeping a close eye on regulatory and policy risk. Staying ahead of changes in securities law, taxation, and fund oversight ensures we’re not caught off guard. And when it comes to capital structure, we prefer a conservative stance on leverage, but we’re willing to be opportunistic in areas like private credit or distressed investments where dislocation can create attractive entry points.

Perhaps most importantly, we believe alignment with values and impact matters. ESG and social responsibility are no longer “nice-to-haves”—they’re central to reputation, access to capital, and long-term value creation. As LPs and stakeholders demand more accountability, we’re prepared to deliver.

Looking Forward: What to Watch

As we look ahead to 2026, several factors will determine the trajectory of private equity:

Interest Rates. If rates come down, deal activity will accelerate and valuations will improve. If they remain high, expect continued pressure on returns.

Trade and Tariff Policy. Global supply chains remain vulnerable to uncertainty. Clearer policy could reduce risk premiums and improve investor confidence.

Regulatory Changes. Adjustments to SEC oversight, taxation, or retirement account access could significantly reshape capital flows.

Exit Markets. Stronger IPO and M&A activity would boost distributions and investor sentiment. Weak exits will mean longer holds and delayed value realization.

Competition. With corporates, SPACs, and other players actively bidding for assets, success will depend on speed, clarity, and operational excellence.

Conclusion: A Time for Judicious Action

The private equity market in 2025 is not for the faint of heart. But times of transition often present the best opportunities for those who are disciplined, patient, and prepared to create real value. At Sandgaard Capital, we’re fortunate to operate without the short-term pressures faced by many firms. That freedom allows us to focus on building durable companies and generating sustainable returns.

For fellow investors, my advice is simple: don’t try to outguess every move in macro policy or interest rates. Focus on what you can control—rigorous due diligence, operational excellence, aligned incentives, and investment theses built on fundamentals, not speculation. That’s how to succeed in private equity’s new normal.

The State of the Economy: Perspective

By: Thomas Sandgaard, CEO of Sandgaard Capital

The U.S. economy continues to capture headlines with a mix of resilience and uncertainty. For business leaders, investors, and households alike, 2025 has been defined by strong underlying growth tempered by persistent challenges. While the outlook remains mixed, clear themes are shaping the path forward.

Growth and Resilience

Despite ongoing global headwinds, the U.S. economy has demonstrated remarkable durability. Consumer spending remains the backbone of growth, supported by steady job creation, rising wages, and household balance sheets that, while tighter than in past years, remain relatively healthy.

Corporate earnings tell a more nuanced story. While sectors tied to discretionary spending and commercial real estate face pressure, industries such as technology, healthcare, defense, and energy continue to drive innovation and long-term investment opportunities. Businesses are adapting quickly, leveraging digital transformation, automation, and supply-chain resilience to protect margins and position themselves for growth.

Inflation and Interest Rates

Inflation has cooled from its peak but remains above the Federal Reserve’s target, keeping monetary policy tighter for longer. However, the balance is shifting: the Fed has begun easing, signaling a more supportive environment ahead.

On September 17, the Federal Reserve cut its benchmark interest rate by 25 basis points to a target range of 4.00%–4.25% — the first reduction since December. Policymakers signaled that two additional cuts are likely by the end of 2025, citing softer job growth and rising unemployment as key factors.

While this shift offers relief, it does not erase challenges:

Headwinds: Borrowing costs remain a significant weight on housing, commercial real estate, and capital-intensive industries. Consumer credit has also tightened, creating stress for households dependent on debt.

Opportunities: Gradual easing opens the door for refinancing and provides an important tailwind for sectors sensitive to rates. Investors with liquidity are also finding attractive entry points in dislocated assets, distressed credit, and industries where overleveraged competitors are forced to retrench.

This evolving environment favors disciplined capital deployment. Companies and investors who maintain flexibility in their balance sheets are well-positioned to capitalize as valuations adjust.

Market Volatility

Equity markets reflect the dual reality of uncertainty and optimism. On one hand, geopolitical risk, energy price swings, and election-year policy debates create meaningful volatility. On the other hand, corporate fundamentals remain steady, supported by productivity gains and resilient demand in key industries.

For long-term investors, volatility is not simply a challenge — it is an opportunity. Mispriced assets, undervalued companies, and sectors temporarily out of favor can all offer attractive entry points for those willing to look past short-term noise.

The Bigger Picture

At Sandgaard Capital, we view today’s economy through both a cautious and opportunistic lens. Elevated rates and shifting consumer dynamics demand prudence, but history reminds us that periods of uncertainty often produce the best investment opportunities.

Our strategy remains consistent:

Invest with discipline and patience.

Focus on long-term value over short-term speculation.

Identify opportunities others overlook — whether in private equity, real estate, or public markets.

Periods like these reward thoughtful investors who combine resilience with bold action.

Closing Thought

The state of the economy is never static — it is dynamic, shaped daily by policy, innovation, and global events. While headlines often emphasize risk, we see resilience, adaptability, and enduring opportunity. At Sandgaard Capital, we remain committed to building lasting value through every stage of the market cycle.